The world’s media industry is on the edge of “a historic transformation” after Warner Bros. Discovery WBD is poised at the “epicenter” of a big change in how assets are being valued and strategic competition by Bank of America (BofA) Global Research. Amid a great deal of consolidation buzz surrounding WBD — which has received at least three key bids from Paramount Skydance (PSKY), Netflix (NFLX), and Comcast (CMCSA) — BofA is expecting no less than “industry realignment” in the auction.

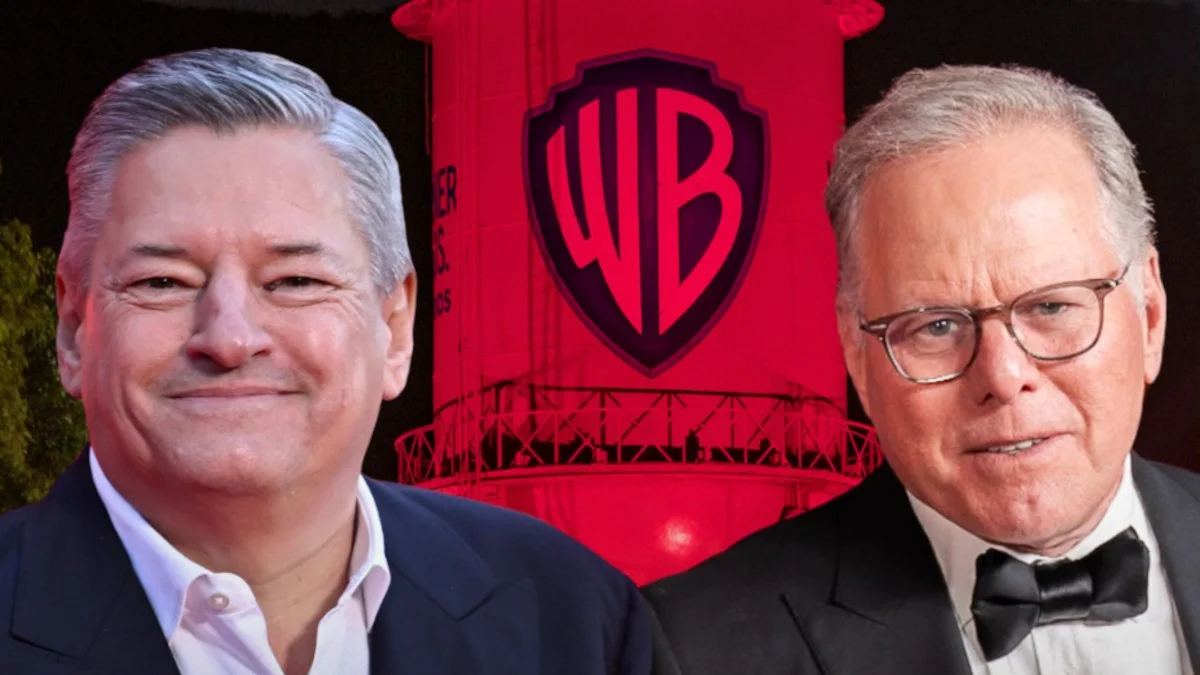

There are many potential outcomes here for WBD, including a full-company acquisition by PSKY or a structural pairing with CMCSA; yet BofA is quick to point out that Netflix has its own strategic trump cards. The report claims an acquisition by Netflix might ultimately result in “killing three birds with one stone,” and WBD is the latest must-have asset as what was once called “the streaming wars” continues to heat up.

A crown-jewel studio

And the fervor for WBD reflects, in large part, the scarcity premium attached to its main asset: Warner Bros. Studio. WBD’s (Harry Potter, DC Comics, and Game of Thrones) IP library makes the studio a “crown jewel” asset, BofA said, as it possesses one of—if not the most valuable—content libraries globally. The combined WBD’s takeout value would be around $30 a share, BofA analysts led by senior media and entertainment analyst Jessica Reif Ehrlich calculated. (At the time of writing, it was trading just above $24.)

Netflix’s attention is said to be focused directly on WBD’s studio and streaming units, so any such transaction would likely exceed that $70 billion price tag. This would be a significant about-face for Netflix, which had previously dedicated more resources to creating original franchises rather than buying existing “franchise moats.” Though Netflix is the uncontested streaming leader in subscribers, it has been behind other media companies in building deep IP libraries with potential use cases for theme parks, gaming, merchandising, and even Broadway shows.

Creating a franchise on the level of Harry Potter “requires significant time and investment,” BofA writes, while buying one would offer instant, low-risk exposure, through not just the existing IP but also potential reboots, prequels, or other franchise extensions.

“Warner Bros.’ library provides a depth to it that Netflix would never be able to organically replicate in time and with reasonable economics across several pieces of IP,” BofA writes, “but more importantly for the pain trade, it puts all of Netflix’s competitors out of business as (nearly) Netflix would own all content creation.” “If Netflix buys Warner Bros., the streaming wars are over,” Ehrlich’s team wrote. Here is how the birds would land if Netflix were to blast its money cannon at WBD.

The triple kill: Consolidating power

The first “bird” to die in a Netflix acquisition would be WBD itself, since its streaming and studio assets would disappear to live inside the largest streaming service.

“Netflix would be the single, unchallenged global Hollywood powerhouse beyond even its currently lofty position,” BofA wrote, with a “content moat” that no stand-alone streamer could match and combined offerings representing more than a fifth of U.S. streaming.

Netflix already accounts for about 18% of total TV streaming viewing time, according to Nielsen data, with HBO Max (WBD) adding another 3%. A combined company would dwarf rivals, including Disney (11 percent) and Amazon Prime Video (8 percent). Only YouTube (28%), which some believe is Netflix’s true rival, would have a larger share.

BofA also forecasts that Netflix would retain Warner Bros. films through traditional theatrical distribution, a flashpoint issue for the big-red streamer for years. Its co-CEO, Ted Sarandos, has been running a long-running cold war—and sometimes a hot one—with theater owners over refusing to play ball on wide releases. Netflix has bought its own boutique theaters in New York (the Paris Theater) and Los Angeles (The Egyptian), where it plays its prestige, Oscar-darling movies, but it hasn’t played nice with wide releases.

The first real chink in that armor may be the Greta Gerwig “Narnia” adaptation. Still, Sarandos stressed that’s a 50-50 deal limited to IMAX releases—an eventized business model Netflix has been familiarizing itself with through its initial foray into sports programming (the NFL games on Christmas Day). Hollywood observers from Puck’s powerful Matt Belloni on down have pondered whether Narnia is some tipping point; a WBD acquisition would be a sure step further in that direction.

The other birds

The second and third “birds” are more specifically aimed at Netflix’s rivals. For midsize legacy media studios/companies, the ability to compete with Netflix’s unit economics or large tech platform ecosystems such as Amazon is diminishing, the report points out. If Netflix acquired War on Everyone, it would be “existential” for both WBD, Paramount, Skydance, and NBC (NBCU), as it would consolidate that central position of power.

If Netflix is successful in buying WBD’s streaming and studio portfolio, it would put a significant damper on the global ambitions of both Paramount+ and Peacock. The BofA team observed that Comcast is a “Twilight Zone monster,” getting ready to spin off its declining cable networks as the as-yet-to-be-formed company Versant (the same direction WBD is heading), while it’s also dealing with a streaming platform even smaller than AT&T’s, which lacks scale domestically and scale even more so abroad.

The BofA team did not raise the prospect of antitrust concerns or other considerations that could affect bidding for WBD. There have been reports that Paramount has pursued WBD with single-minded determination for nearly a year; it is controlled by the Ellison family, which has had significant entwining ties to the White House, with Oracle founder Larry Ellison a power figure as one of the world’s wealthiest men and also a big player in AI and technology.

Ellison was one of several prominent names — including Rupert Murdoch and Michael Dell — who surfaced in the consortium seeking to take control of TikTok’s U.S. arm. A Paramount led by his son, David Ellison, who recently came in to remake CBS News with the hiring of the Free Press’s Bari Weiss as editor-in-chief, would be a wholly different proposition with a new headline jewel in its crown.